Advertisements

The power of the mind over our financial decisions is a fascinating and often underestimated topic. The way we think and feel can have a profound impact on how we manage our money, from investment decisions to daily spending habits. This phenomenon, known as financial psychology, reveals that our emotions, beliefs, and psychological predispositions play a crucial role in our financial stability.

In this post, we'll explore how the human brain influences our everyday financial decisions, often unconsciously. We'll analyze the cognitive biases that affect our choices and how these can lead us to make financial mistakes that impact our personal finances. Understanding these mental processes is critical to identifying harmful patterns and transforming them into positive habits that promote financial health.

Advertisements

In addition, practical strategies and tips will be provided on how to improve financial decision-making by recognizing and managing these biases. From the importance of financial education to self-assessment techniques and mindfulness, various tools will be discussed that help foster positive change in our financial habits. The key to achieving financial stability lies not only in the numbers, but in understanding how our minds influence those numbers.

The journey toward financial stability is both an inner and outer journey. By the end of this reading, each individual will feel more empowered to make informed and conscious financial decisions, thus achieving a balance between emotions and finances. Discover how to transform your mind into an ally in achieving your financial goals and ensuring a prosperous financial future.

Advertisements

The connection between the mind and financial decisions

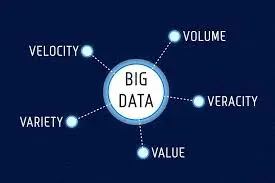

Understanding how the mind influences our financial decisions is a crucial first step toward improving our financial habits. Financial psychology studies precisely this link, showing that our emotions, perceptions, and beliefs can lead us to financial behaviors that aren't always rational. For example, confirmation bias causes us to seek information that supports our preexisting beliefs about money, which can influence how we manage our finances. Furthermore, fear of risk can prevent us from making decisions that, although uncertain, could be beneficial in the long term.

On the other hand, emotions like anxiety and stress often cloud our judgment, leading us to make impulsive decisions, such as making impulse purchases or selling investments out of fear of losing. These decisions don't always align with our long-term financial goals.

Identifying harmful financial habits

Before we can improve our financial habits, it's essential to identify those that are harmful. Some common signs of unhealthy financial habits include spending more than we earn, not having a clear budget, and avoiding planning for future savings. These behaviors can be the result of negative thought patterns, such as believing that we can always count on credit or a credit card to solve emergencies.

Other habits include not tracking spending, which often results in unpleasant surprises when checking your bank statement. There's also the habit of putting off important decisions, such as investing for retirement, which can lead to a lack of preparation for the future. Recognizing these patterns is the first step toward change.

The role of limiting beliefs

Limiting beliefs are deeply held ideas that prevent us from reaching our full financial potential. For example, believing “I'll never be good with money” or “I'll never be able to save enough” can sabotage our efforts. These beliefs are often formed from past experiences or even what we've learned from family and friends. Identifying these beliefs and working to transform them is key to changing our financial habits.

Strategies to improve financial health

Improving our financial health requires a conscious and deliberate approach. Starting with a clear and detailed budget is one of the most effective strategies. This allows us to visualize our income and expenses, helping us identify areas where we can cut back and save more. Using budgeting apps can simplify this process and keep us accountable.

Another strategy is to set specific financial goals, such as saving for an emergency fund, paying off debt, or planning for retirement. These goals should be clear and achievable, which will provide motivation and direction. Additionally, automating savings by setting up automatic transfers to a savings account can help us maintain consistency effortlessly.

The importance of financial education

Financial education is essential for making informed decisions about our money. Investing time in learning about basic financial concepts, such as interest rates, investing, and retirement planning, empowers us to make smarter decisions. Many resources, such as online courses and books, are available to help us improve our financial knowledge.

- Participate in workshops or seminars on personal finance.

- Read books by well-known authors in the financial field.

- Use financial simulators to better understand investments.

Developing a positive financial mindset

Developing a positive financial mindset is crucial for long-term financial stability. This involves shifting our perspective toward money and seeing it as a tool to achieve our goals, rather than an obstacle. Practicing gratitude and focusing on what we have, rather than what we lack, can improve our relationship with money.

Additionally, cultivating patience is essential, as financial improvements often don't happen overnight. Understanding that progress may be slow but steady helps us stay focused on our goals without getting discouraged. Positive affirmations and visualizing our goals can also help us stay motivated and committed.

Overcoming the fear of financial failure

The fear of financial failure can paralyze us and prevent us from making important decisions. To overcome this fear, it's essential to face our insecurities and learn from past mistakes rather than avoid them. Failure should be seen as an opportunity to learn and grow.

It's also helpful to seek the support of a community or mentor who can offer guidance and support. Sharing experiences with others facing similar challenges can provide comfort and new insights into how to manage our finances effectively.

Conclusion

The connection between the mind and financial decisions is undeniably powerful. Throughout this article, we've explored how our thoughts and emotions influence our daily financial choices. By understanding these mental mechanisms, we can take concrete steps to improve our financial habits and ultimately achieve lasting financial stability.

To begin, it's essential to be aware of the cognitive biases that can lead us to irrational decisions. Identifying these mental patterns allows us to implement effective strategies to avoid them. For example, establishing a monthly budget can help limit impulsive spending, while investing in financial education empowers us with the knowledge necessary to make more informed decisions.

Furthermore, long-term planning is a key element. By defining clear and specific financial goals, we create a path that guides us toward financial success. Setting measurable and achievable goals not only provides direction but also increases our motivation and commitment.

Finally, remembering that patience and discipline are crucial allies on this journey toward financial stability is essential. With determination and consistent focus, we can transform our financial habits and ensure a more prosperous and secure future.

In short, our minds have a significant impact on our financial decisions, but with the right tools and strategies, we can improve our practices and achieve the financial stability we desire.